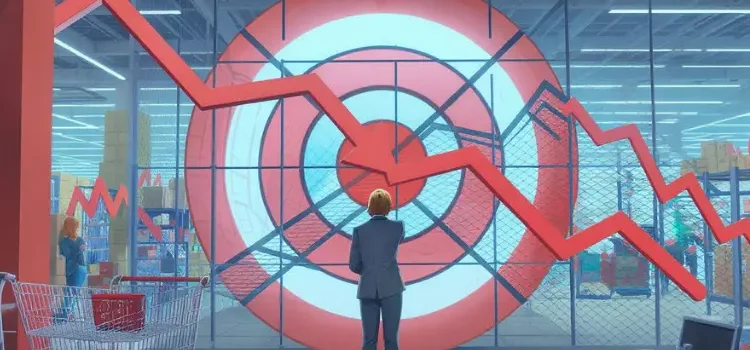

Sensex Slides 245 Points as Stock Markets Extend Losses

Sensex slides 245 points as stock markets extend losses for the second consecutive session highlighting growing caution across domestic equities. Investors remained selective as global uncertainty rising valuations and mixed corporate cues influenced market sentiment. While early trade showed signs of stability selling pressure gradually intensified leading to a broad based decline by the closing bell.

The mood across Dalal Street reflected a wait and watch approach as traders assessed global developments alongside domestic macro signals. Mid cap and small cap stocks also struggled to find strong support reinforcing the cautious undertone that shaped the trading session.

Global cues weigh on investor confidence

Overseas markets played a significant role in shaping domestic trends as mixed global cues kept risk appetite under pressure. Concerns around interest rate trajectories geopolitical developments and uneven economic data from major economies contributed to subdued sentiment. As global investors adopted a defensive stance Indian equities mirrored the cautious outlook.

Sensex slides 245 points as stock markets extend losses partly due to this global hesitation which limited fresh inflows. Foreign institutional investors showed restrained activity while domestic investors preferred to stay selective focusing on fundamentally strong stocks rather than broad exposure.

Sector performance reflects selective selling

Sectoral indices presented a mixed picture though the overall tone remained weak. Banking and financial stocks faced mild pressure as investors booked profits after recent gains. Technology stocks also traded cautiously as global demand outlook remained uncertain affecting IT industry news sentiment.

Meanwhile consumer focused sectors showed relative resilience supported by stable domestic demand expectations. However selling in heavyweight stocks offset gains in defensives leading to a net negative close for benchmark indices.

Market sentiment shaped by domestic factors

Domestic factors added another layer of complexity to the session. Investors continued to track inflation trends policy expectations and corporate earnings outlook. Finance industry updates around credit growth and liquidity conditions influenced banking stocks while expectations around government spending supported selective interest in infrastructure linked names.

Sensex slides 245 points as stock markets extend losses also reflected cautious positioning ahead of upcoming economic data releases. Many participants chose to reduce exposure temporarily rather than take aggressive directional bets.

Broader market trends and investor behavior

The broader market showed signs of consolidation as traders focused on quality rather than momentum. Volatility remained contained indicating an orderly pullback instead of panic driven selling. This behavior suggests that investors are recalibrating portfolios based on medium term expectations rather than reacting emotionally to daily fluctuations.

Alongside equities themes related to technology insights HR trends and insights and marketing trends analysis continued to influence sector specific stocks. Companies aligned with digital transformation and efficiency driven business models attracted selective buying interest even on a weak market day.

Impact on business and strategic planning

Market movements often influence corporate strategy and investor communication. Sales strategies and research teams closely monitor equity trends to gauge consumer confidence and business expansion plans. A cautious market environment encourages companies to prioritize cost efficiency innovation and long term value creation.

Sensex slides 245 points as stock markets extend losses serves as a reminder that short term volatility is part of the market cycle. Businesses that align financial planning with realistic growth assumptions tend to navigate such phases more effectively.

Actionable insights for investors and professionals

Periods of market softness offer opportunities for learning and recalibration. Investors can focus on reviewing portfolio diversification and aligning holdings with long term goals rather than short term noise. Tracking finance industry updates alongside IT industry news helps identify sectors with sustainable growth potential.

For professionals and business leaders market trends provide valuable signals. Understanding shifts in capital flows consumer sentiment and corporate performance can support better decision making across investment planning hiring strategies and marketing initiatives.

Staying informed and adaptable remains essential in an environment where global and domestic factors continuously reshape market direction.

To gain deeper insights into market trends and business strategy connect with BusinessInfoPro for expert analysis and guidance. Reach out today to stay ahead with informed perspectives that support smarter financial and strategic decisions.

Source : thehindu.com