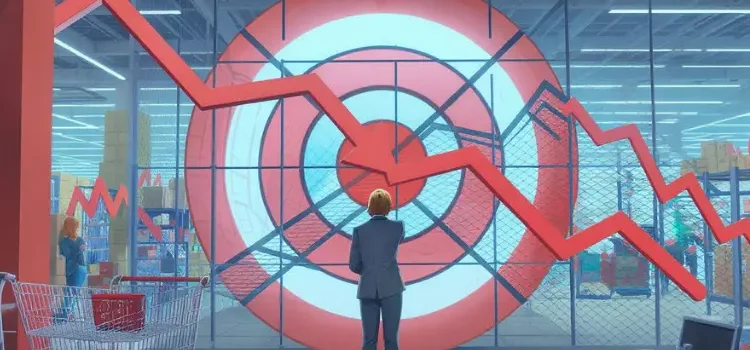

Why Your Win Rate Will Be the Most Critical Sales Metric in 2025 is becoming increasingly evident as businesses navigate an environment shaped by heightened competition, data-driven decision-making, and evolving customer expectations. In a marketplace where every lead, touchpoint, and interaction carries measurable value, organizations are shifting their focus toward metrics that reveal real impact rather than vanity indicators. The win rate stands at the center of this shift because it directly reflects the effectiveness of sales processes, team alignment, and customer trust. As leaders explore new Technology insights and evaluate the influence of automation and AI on buying behavior, the significance of this metric only continues to grow.

The Rising Importance of Outcome-Based Measurement

Why Your Win Rate Will Be the Most Critical Sales Metric in 2025 ties back to how companies are redefining success in both short-term performance and long-term strategy. Many traditional metrics highlight activity levels or pipeline size, but win rate exposes whether a team can consistently convert opportunities into revenue. This shift toward outcome-based measurement is emerging strongly across Sales strategies and research, especially as businesses refine their forecasting models. Executives recognise that accurate predictions depend on understanding not just how much is in the pipeline but how effectively teams close deals. With economic uncertainty shaping many Finance industry updates, this clarity becomes essential for sustainable planning.

Alignment Between Sales Motions and Customer Expectations

Why Your Win Rate Will Be the Most Critical Sales Metric in 2025 also reflects how deeply customer expectations influence buying decisions. Modern buyers are more informed than ever, and they assess solutions through a lens shaped by digital experiences, productivity tools, and trust in brand communication. As a result, win rate has become a powerful indicator of how well a sales team understands these shifting expectations. Marketing trends analysis shows that alignment between marketing and sales messaging has a direct impact on deal conversion, making win rate a reflection of cross-department synergy. When teams communicate value consistently, customers experience fewer friction points, and the likelihood of closing a deal increases dramatically.

Technology’s Role in Elevating Win Rate Impact

Why Your Win Rate Will Be the Most Critical Sales Metric in 2025 becomes even clearer with the rapid integration of AI-powered platforms, predictive analytics, and automation tools. Advances highlighted in IT industry news reveal that modern sales teams rely on technology to enhance prospect identification, personalize outreach, and analyze behavioral signals. These tools provide visibility into patterns that influence win rate, from engagement timing to buyer intent scoring. By understanding which actions lead to successful outcomes, organizations can reshape processes to strengthen deal conversion. As businesses continue to invest in intelligent systems, win rate emerges as the most reliable indicator of whether these tools translate into meaningful performance gains.

The Cultural and Operational Influence of Win Rate

Why Your Win Rate Will Be the Most Critical Sales Metric in 2025 is also tied to the cultural evolution within sales organizations. High-performing teams use win rate as a guide for coaching, skill development, and operational improvement. HR trends and insights show that sales roles are increasingly evaluated on adaptability, strategic communication, and data literacy. Win rate highlights gaps in these areas in a way activity-focused metrics cannot. By using this single measure, leaders can make informed decisions about training priorities, hiring strategies, and workflow improvements. Over time, this fosters a culture built around precision, strategic alignment, and continuous performance enhancement.

Transforming Leadership Decision-Making

Why Your Win Rate Will Be the Most Critical Sales Metric in 2025 carries strategic implications for senior leadership as well. Executives rely on clear KPIs to allocate budgets, plan market expansion, and evaluate product effectiveness. A strong win rate signals that teams understand their market, articulate value convincingly, and navigate competitive pressures successfully. When leadership reviews Finance industry updates and broader economic trends, an accurate win rate offers confidence in planning even during uncertain conditions. This makes the metric a grounding force for decision-making, offering clarity that ensures resources are invested wisely and aligned with growth opportunities.

The Market’s Shift Toward Efficiency and Precision

Why Your Win Rate Will Be the Most Critical Sales Metric in 2025 aligns with the larger business trend of prioritizing efficiency over volume. Many organizations are moving away from outdated models that emphasized chasing every possible lead. Instead, they now focus on pursuing high-intent opportunities with tailored strategies. As this mindset becomes more widespread, win rate acts as the clearest reflection of whether teams are working intelligently rather than merely working harder. The metric encapsulates quality of engagement, relevance of solutions, and strength of customer relationships, making it invaluable in a market defined by precision-driven growth.

Actionable Insights for Sales Teams and Business Leaders

Understanding Why Your Win Rate Will Be the Most Critical Sales Metric in 2025 gives organizations a strategic advantage in a rapidly changing environment. Leaders can empower their sales teams by analyzing patterns behind both successful and unsuccessful deals, creating training programs that reinforce value-based selling, and aligning marketing messaging with real customer expectations. Integrating intelligent technologies enhances forecasting accuracy, while a stronger focus on buyer experience naturally lifts win rate performance. Teams that embrace these insights position themselves to outperform competitors and thrive in a landscape reshaped by evolving digital behavior.

Ready to sharpen your strategy for 2025?

Partner with BusinessInfoPro to access deeper insights, expert analysis, and guidance that elevates your decision-making. Connect with us today and stay ahead of every shift shaping tomorrow’s business landscape.